The 206% Reset: Why Dubai’s Villa Market Has Eclipsed the 2014 Peak

The numbers are in, and they confirm what seasoned investors have suspected: Dubai hasn’t just recovered; it has reset. With villa values now 206% above post-pandemic levels, the market has officially decoupled from historical cycles to enter a new era of “structural sustainability.”

According to the latest data from ValuStrat, average freehold villa values are not only up triple digits since 2020 but are now trading 86% above the historic 2014 market peak. This is no longer a rebound—it is a redefinition of Dubai’s real estate baseline.

Market Performance Snapshot

It’s Not Hype, It’s Maturity

The sheer scale of these gains might alarm skeptical observers, but industry leaders point to fundamental shifts in demand. Badar Rashid AlBlooshi, Chairman of Arabian Gulf Properties, emphasizes that this cycle is distinct from the speculative bubbles of the past.

This “structural shift” refers to the transition from a transient, renter-heavy market to one dominated by long-term residents and global capital seeking safe havens.

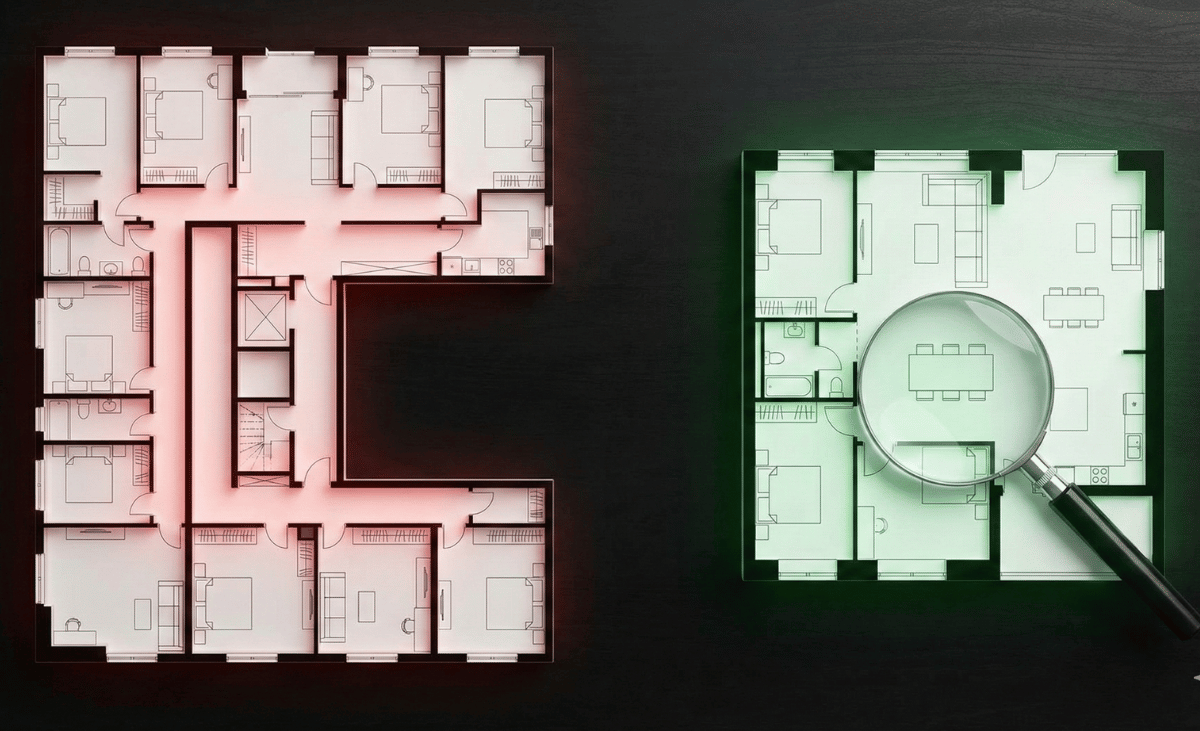

The “Scarcity Winners”: Where the Growth Is

Not all villas are created equal. The data shows that price appreciation is heavily concentrated in supply-constrained, well-established communities. These areas share three traits: mature infrastructure, limited new land for development, and integrated master planning.

- Jumeirah Islands: High privacy, water-centric living.

- Palm Jumeirah: The eternal global icon.

- The Meadows & Victory Heights: Established family favourites.

- Mudon & Green Community West: Green, community-focused hubs.

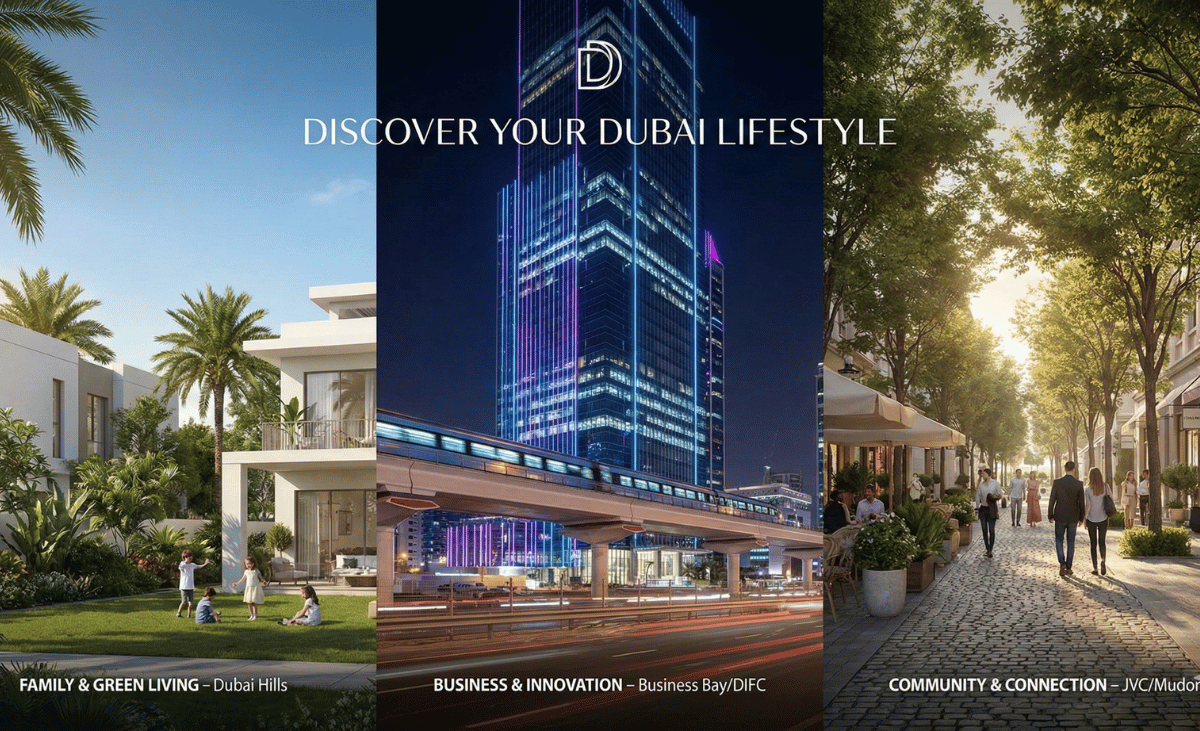

Apartments: The Sleeping Giant Wakes Up

While villas have grabbed the headlines, the apartment sector has quietly achieved a massive milestone. For the first time, apartment prices have surpassed the 2014 peak.

This is a critical indicator of market balance. While luxury districts like Downtown Dubai and Business Bay drive the high end, mid-market communities are seeing robust gains due to population growth. Areas like Dubai Silicon Oasis, Remraam, and The Greens are performing exceptionally well, driven by genuine end-user demand rather than speculation.

What This Means for 2026

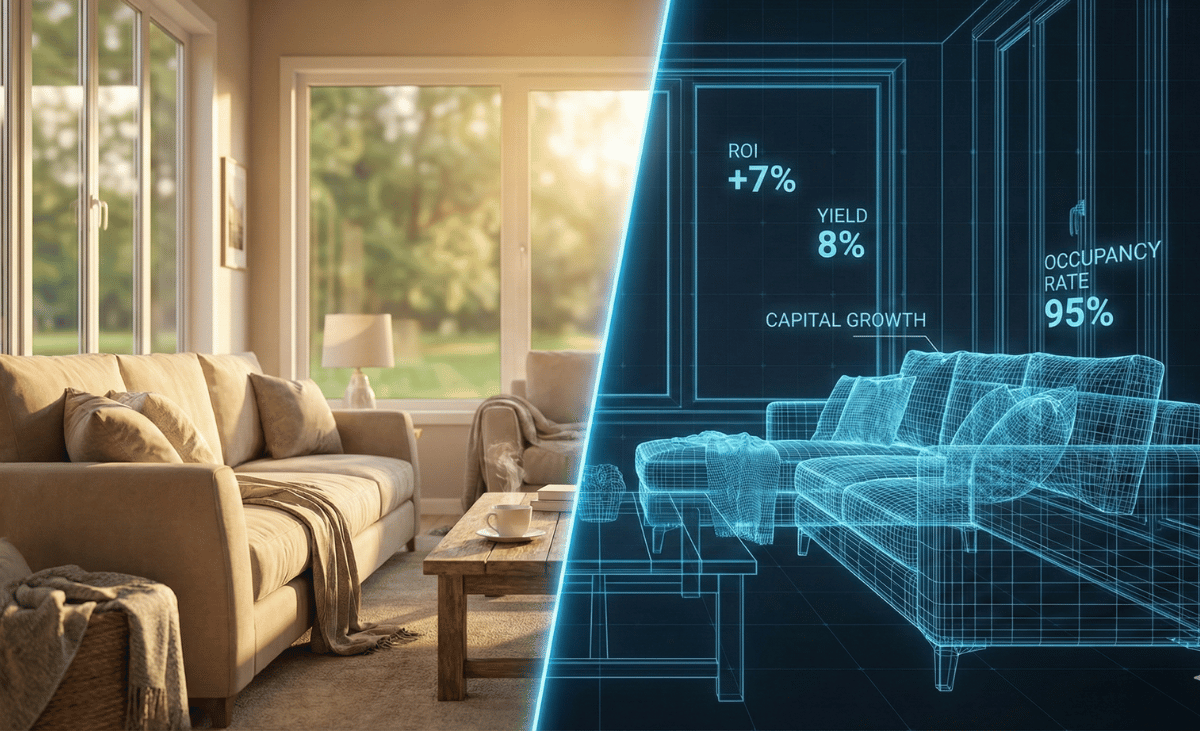

The data suggests we are moving away from volatility and towards “structured stability.” With annual capital growth for villas still at a healthy 25.5%, the momentum is strong, but the drivers are different. Buyers are no longer flipping paper; they are buying lifestyle and legacy.

For investors, the window for “undervalued” assets is closing in prime areas, shifting the opportunity to emerging luxury zones and high-yield apartment sectors that are playing catch-up to the villa market.