The Rise of Branded Residences: Is the Premium Worth It?

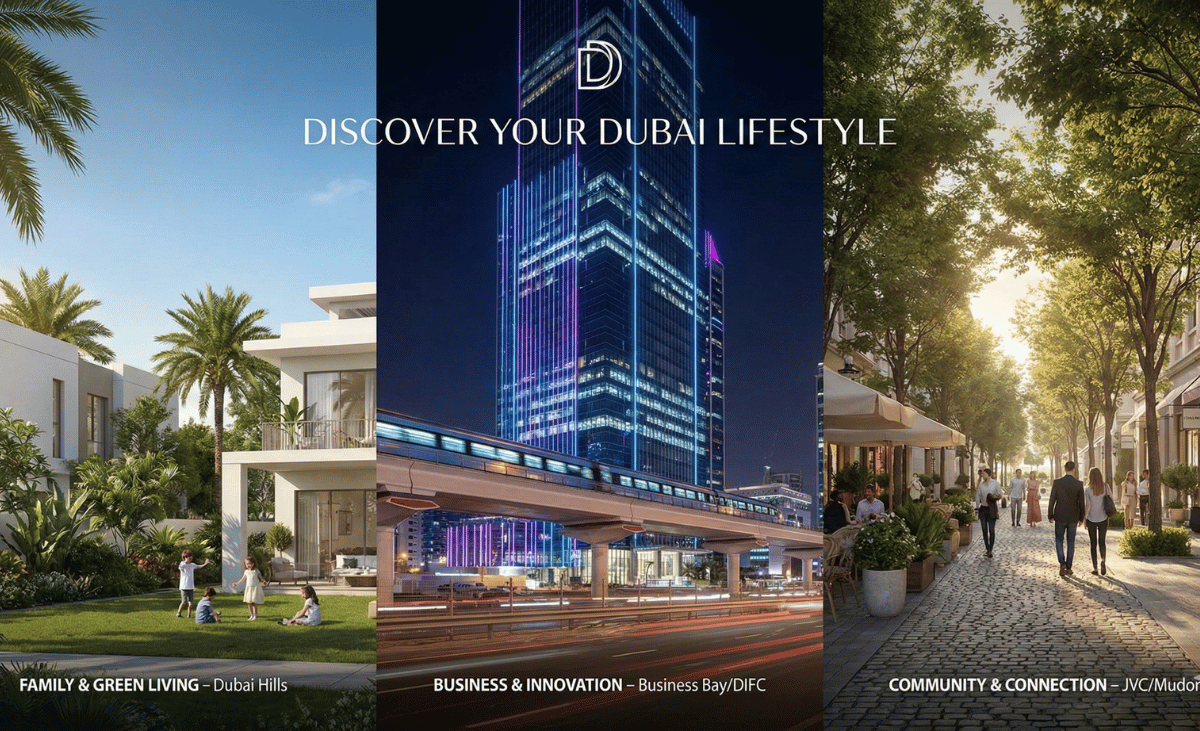

Dubai has become the global capital of branded residences. Projects bearing names like Four Seasons, Ritz-Carlton, Bugatti, and Mercedes-Benz are commanding the highest prices per square foot in the market. But is it just a name?

The “Trophy Asset” Appeal

High-Net-Worth Individuals (HNWIs) are not just buying a home; they are buying a lifestyle and a status symbol. These properties offer hotel-grade services—concierge, valet, housekeeping—within a private residential setting.

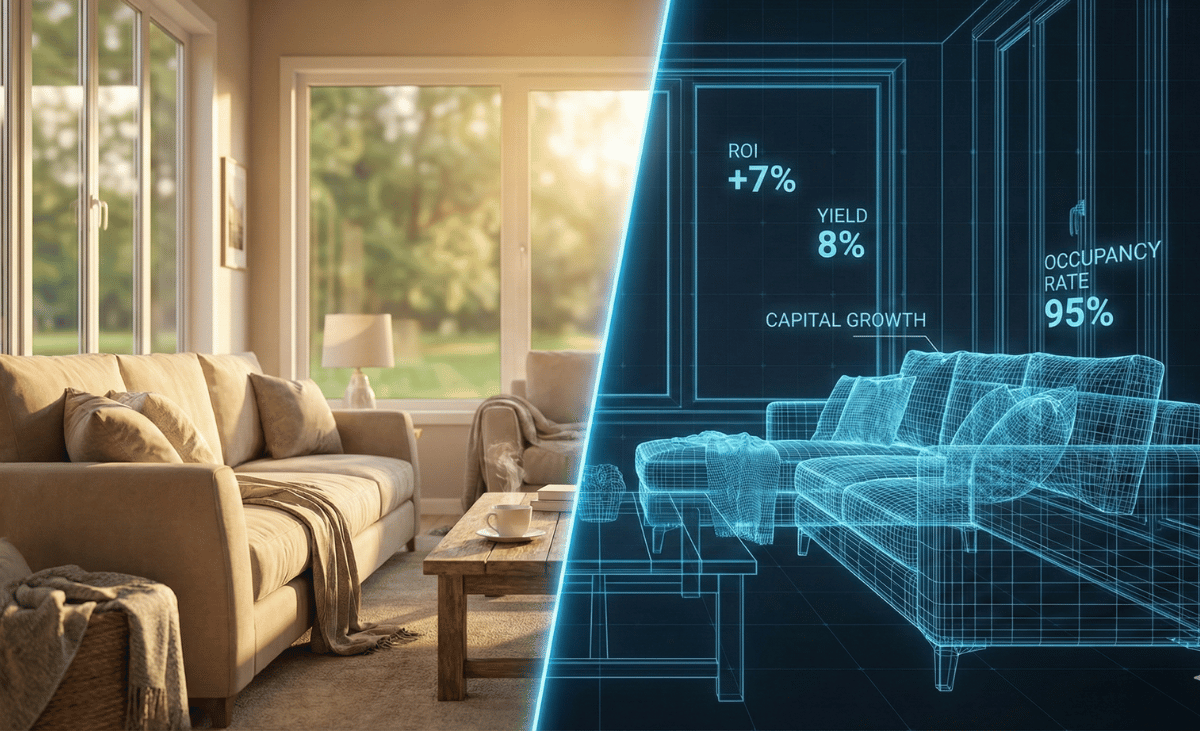

Investment Performance

Data shows that branded residences in Dubai command a premium of 25-35% over non-branded luxury units in the same area.

- Resale Value: They hold value better during market downturns due to the trust associated with the brand.

- Rental Demand: They attract a specific tier of tenant willing to pay top dollar for guaranteed service quality and security.

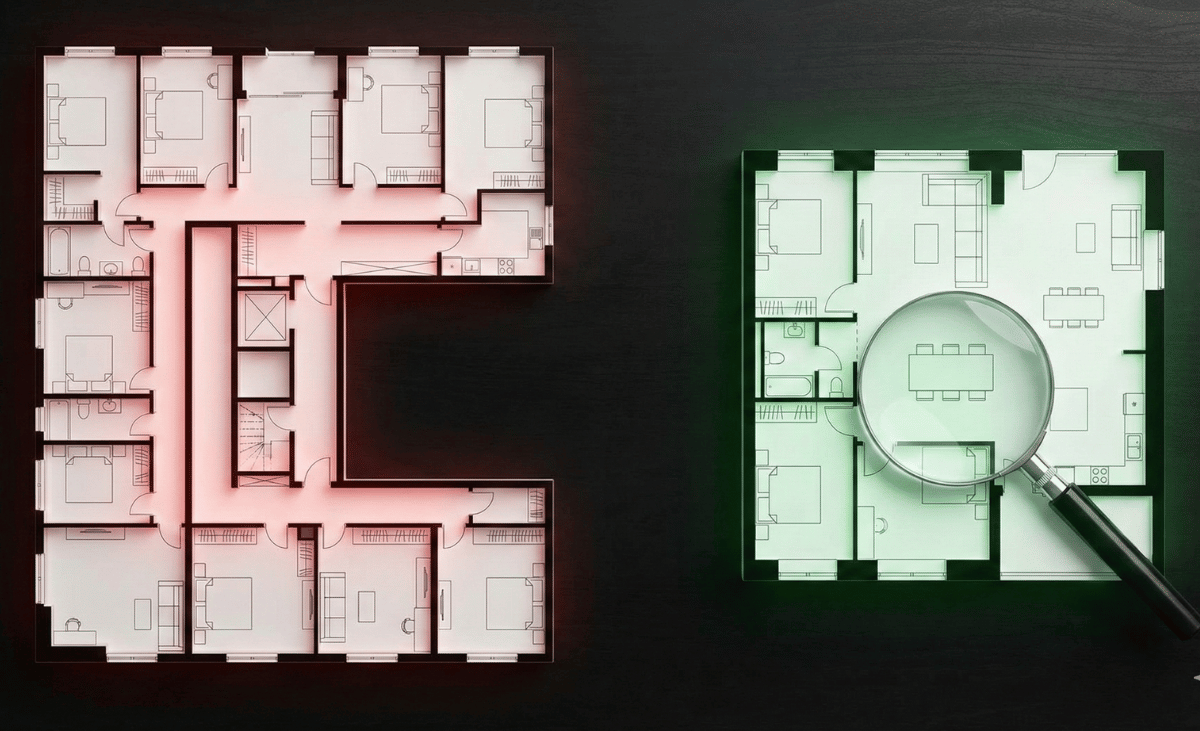

The scarcity Factor

Unlike generic towers, branded residences are often limited editions. This scarcity drives long-term capital preservation, making them a “safe haven” asset class for global wealth.

Key Takeaway: For the ultra-luxury investor, branded residences offer a blend of real estate appreciation and brand equity that generic luxury cannot match.