The Hybrid Trap: Why You Can’t Be Both an Investor and an End-User

The biggest mistake we see isn’t buying in a bad location or overpaying—it’s strategic confusion. Buyers often say, “I want a high-ROI investment that I can also live in someday.” This sounds logical, but in practice, it is where problems begin. Buying an investor unit for self-use leads to regret, and buying an emotional home as an investment usually destroys your returns.

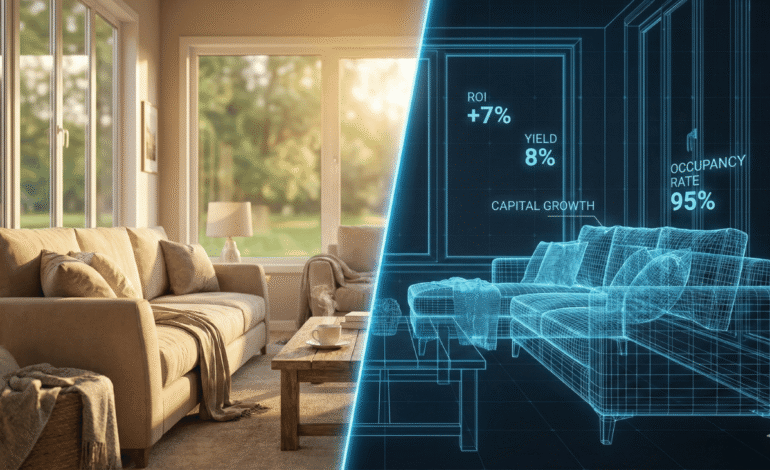

Two Different Worlds, Two Different Metrics

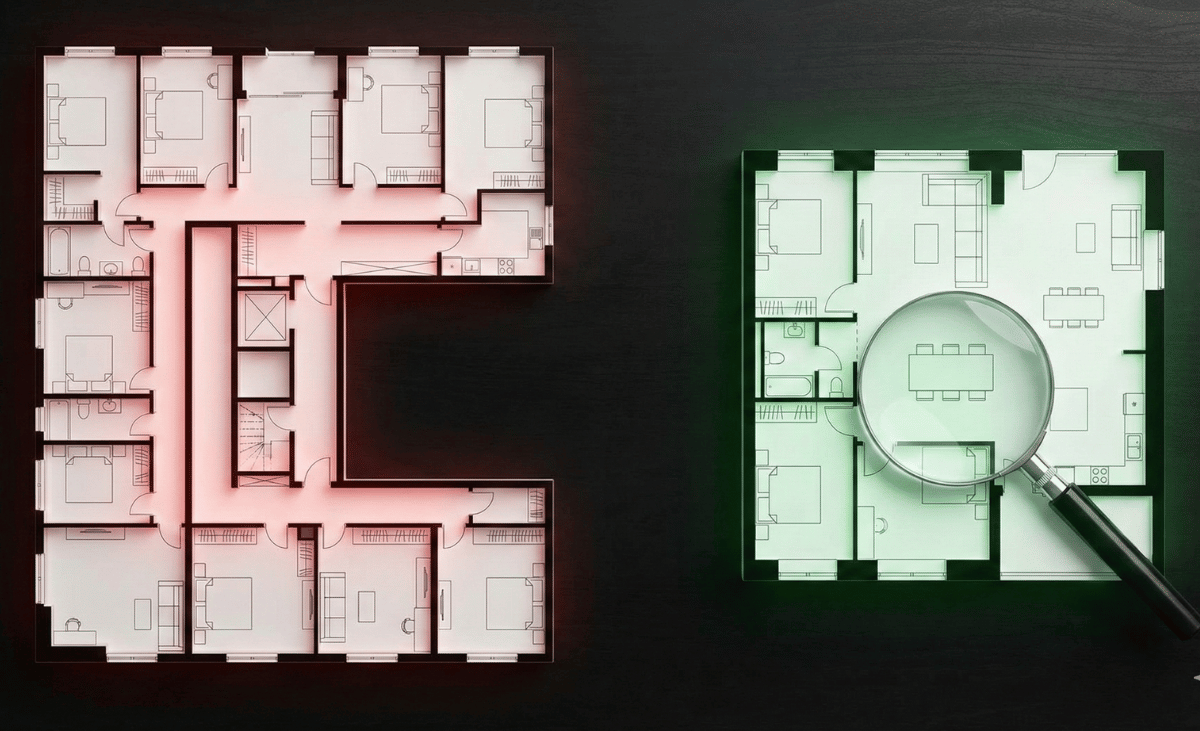

Real estate is not a “one size fits all” asset class. The features that make a property a great home are often the exact features that make it a terrible investment, and vice versa.

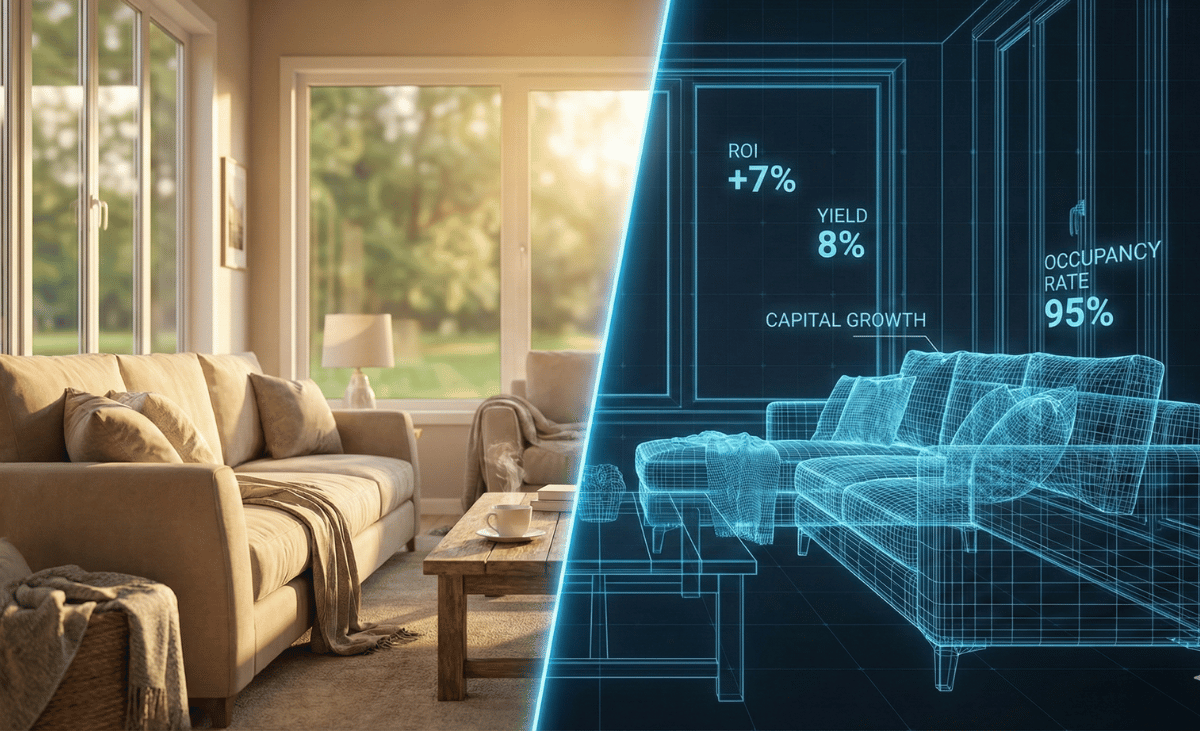

The Investor Mindset

Primary Goal: ROI & Capital Appreciation.

Key Drivers: Entry price, Service Charges, Tenant Demand.

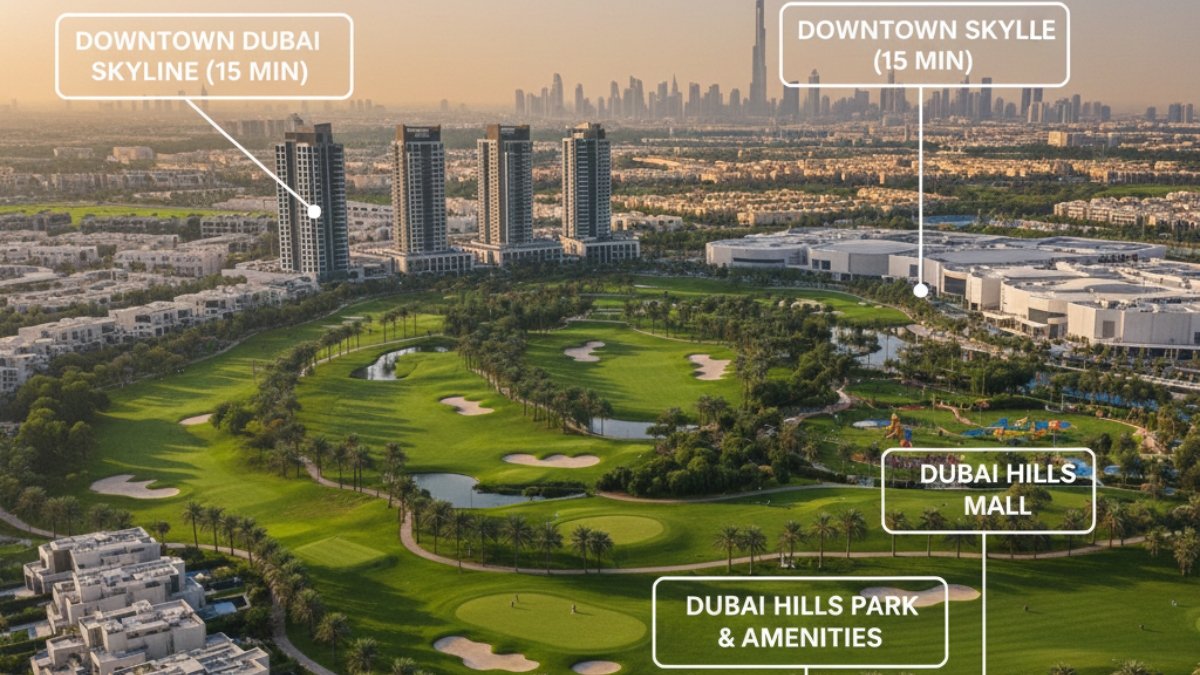

The “Perfect” Unit: A studio or 1-bed in a high-density area (JVC, Business Bay). It has standard finishes but rents out in 24 hours.

Emotion: Zero. It is a spreadsheet decision.

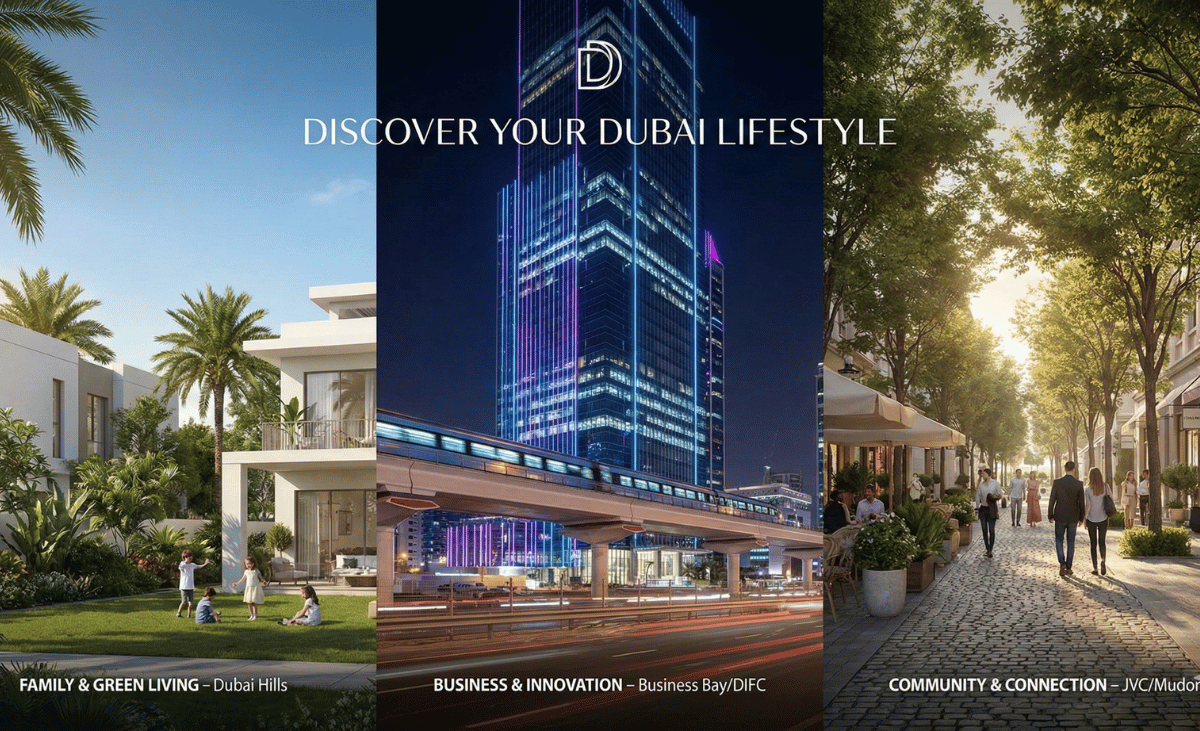

The End-User Mindset

Primary Goal: Quality of Life & Stability.

Key Drivers: Layout flow, Ceiling height, School proximity, Neighbors.

The “Perfect” Unit: A 3-bed with a park view. It might have high service charges and a high price tag, but it feels like “home.”

Emotion: High. It is a heart decision.

The “Hybrid Mistake”: A Case Study

Let’s look at a common scenario. Buyer Ahmed wants to invest but thinks, “Maybe I’ll live there later.”

He rejects a high-yield studio in JVC because “it’s too small for me.” Instead, he buys a premium 1-bedroom in a luxury Downtown tower for AED 2.5 Million. It has marble floors and a concierge.

- The Reality: When he tries to rent it, the high service charges (AED 30/sqft) eat his profit. His net yield is only 3.5%.

- The Regret: As an investment, it performs poorly compared to the JVC studio that would have netted 7%. As a home, he realizes 5 years later that a 1-bedroom doesn’t fit his growing family anyway.

How to Pick a Lane

Clarity of purpose is the first step to wealth. Before you view a single property, you must make a binary choice.

If You Are an Investor:

You must be ruthless. Do not look at the view. Do not touch the kitchen countertop. Look at the numbers.

Ask: What is the price per square foot? What is the average rental rate in this building? Are the service charges sustainable?

If You Are an End-User:

You must be selfish. Ignore the rental yield. Focus on your daily routine.

Ask: Is the kitchen big enough for my cooking? Is the commute to my office tolerable? Is the community safe for my kids?