Off-Plan vs. Ready Property: Which Strategy Wins in 2026?

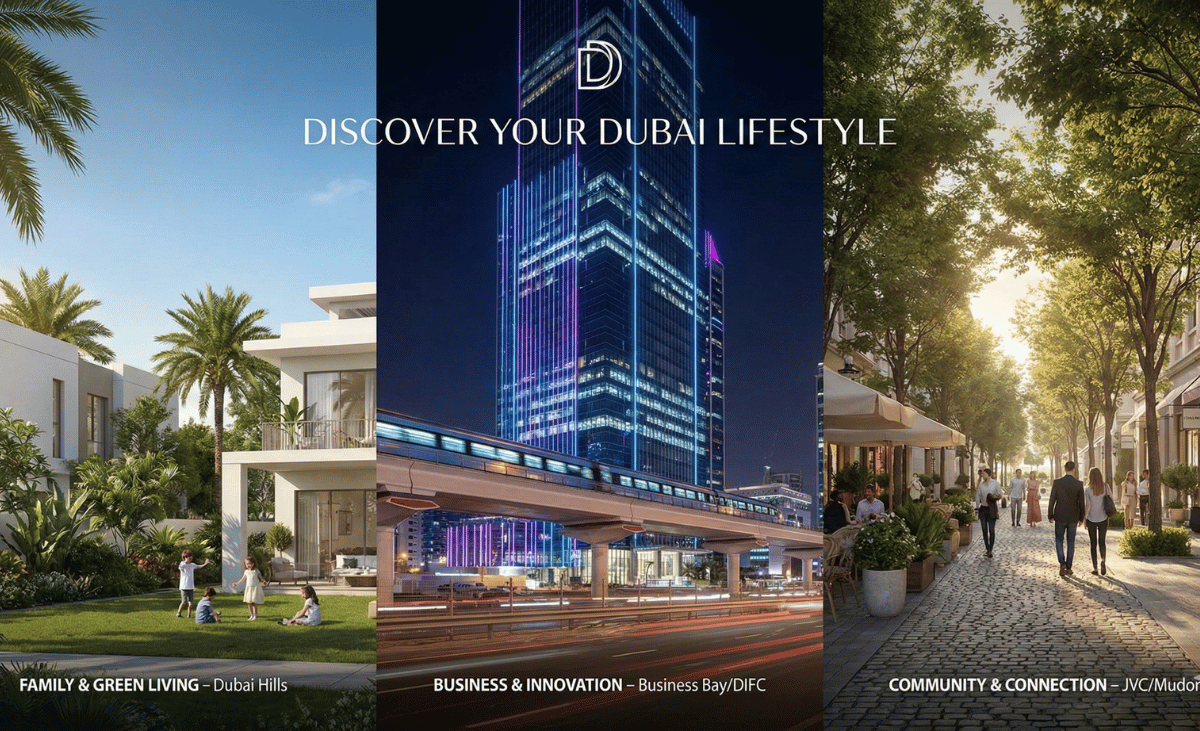

The eternal debate for Dubai investors: buy off-plan or buy ready? In 2026, the answer depends entirely on your financial goals.

The Case for Off-Plan

Off-plan properties continue to dominate transaction volumes, accounting for nearly 70% of sales in late 2025.

- Payment Flexibility: Developers are offering attractive post-handover payment plans (e.g., 1% per month), allowing investors to manage cash flow without a mortgage.

- Capital Gains: Buying at “launch price” often secures equity gain by the time the key is handed over.

The Case for Ready Property

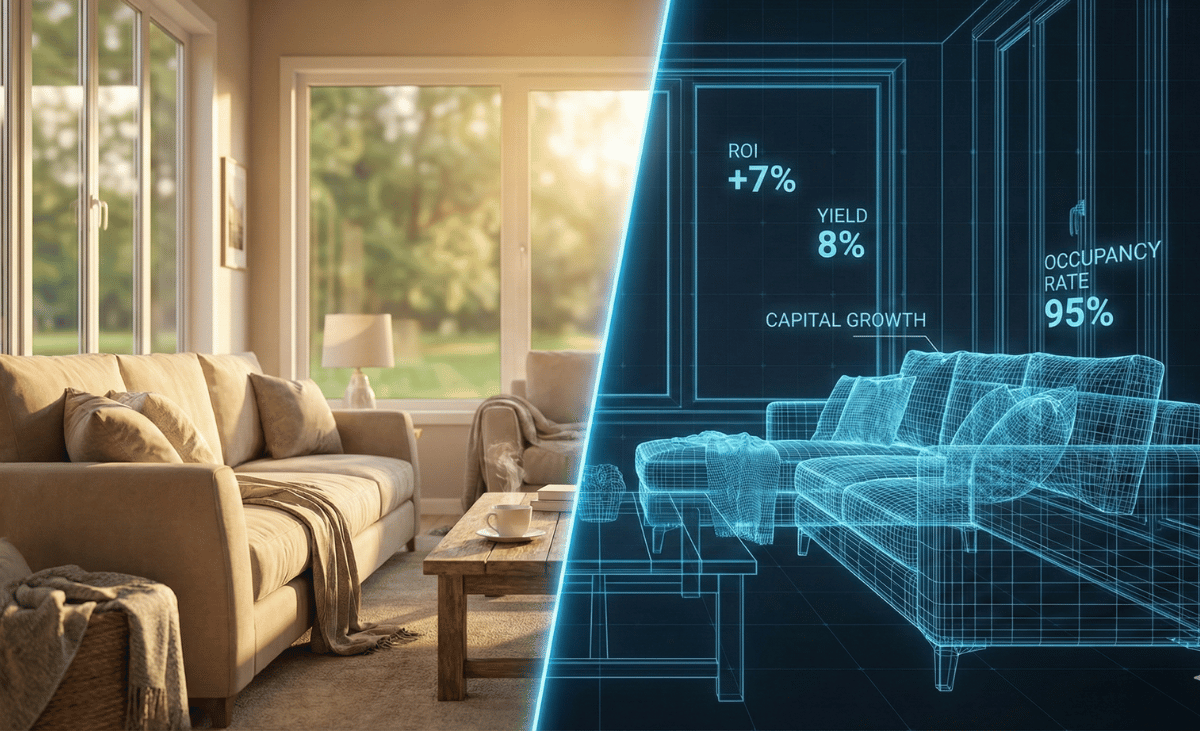

With rental rates at historic highs, ready properties offer something off-plan cannot: immediate cash flow.

- High Yields: Investors can immediately tap into rental yields of 6-8% (or higher for short-term rentals).

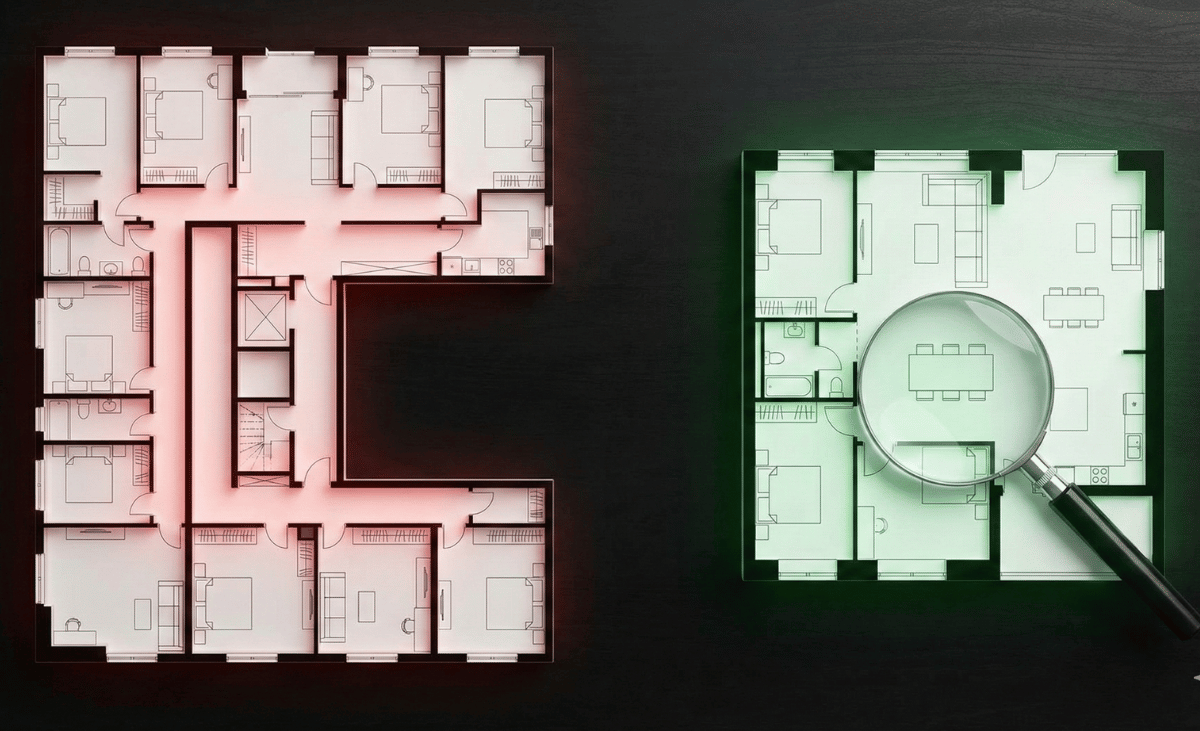

- Lower Risk: You can see exactly what you are buying. There is no risk of project delays or cancellations.

The Verdict

- Choose Off-Plan If: You want capital appreciation and have a smaller initial deposit.

- Choose Ready If: You need passive income immediately to offset inflation or lifestyle costs.

Key Takeaway: Diversification is key. A balanced portfolio might include one ready unit generating rent to pay off the installments of an off-plan investment.