Dubai 2026: The Market Has Evolved from “Hype” to “Structured Stability

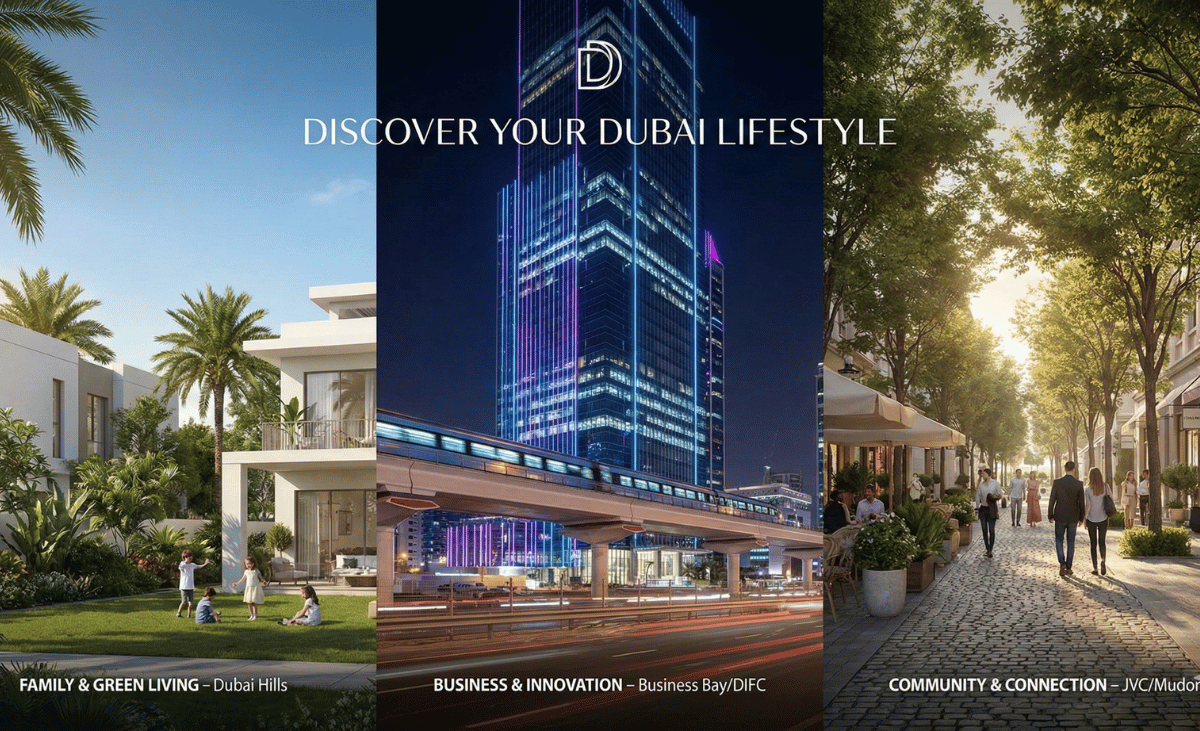

If you’ve been tracking Dubai’s real estate headlines, you might be looking for the next massive spike or waiting for a sudden dip. But the market is sending a different signal entirely: we are entering a phase of high-level regulation and professional maturity.

As we approach 2026, Dubai’s real estate sector is moving beyond the era of rapid, unchecked growth and short-term speculation. For investors, this evolution is a game-changer. The question is no longer if the market will grow, but how you can position yourself strategically before the 2026 landscape is fully established.

1. Structural Resilience is the New Standard

Over the last few years, Dubai’s property sector hasn’t just grown; it has matured. The market is now supported by:

- Near-completion of major infrastructure projects: Enhancing connectivity and community value.

- Regulatory Clarity: Stricter rules that protect investors and ensure project delivery.

- Institutional Capital: A surge in long-term investment from global institutions, not just individual speculators.

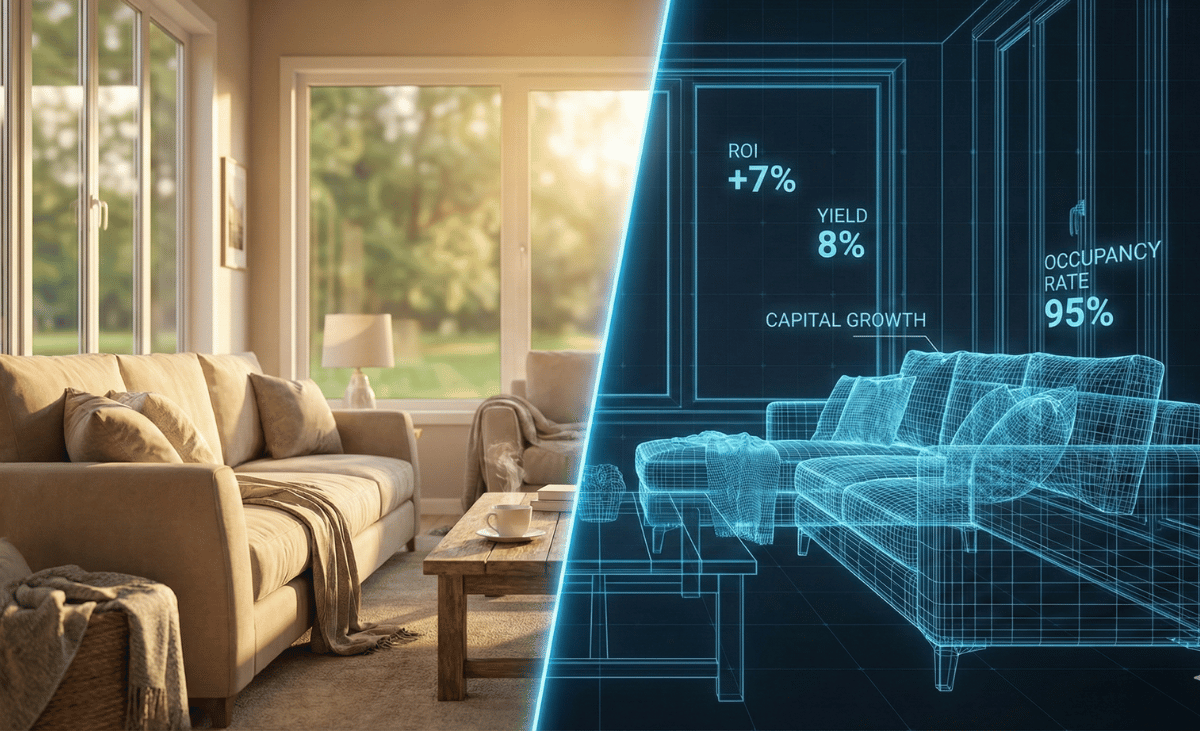

2. Opportunity Hasn’t Vanished; It Has Reshaped

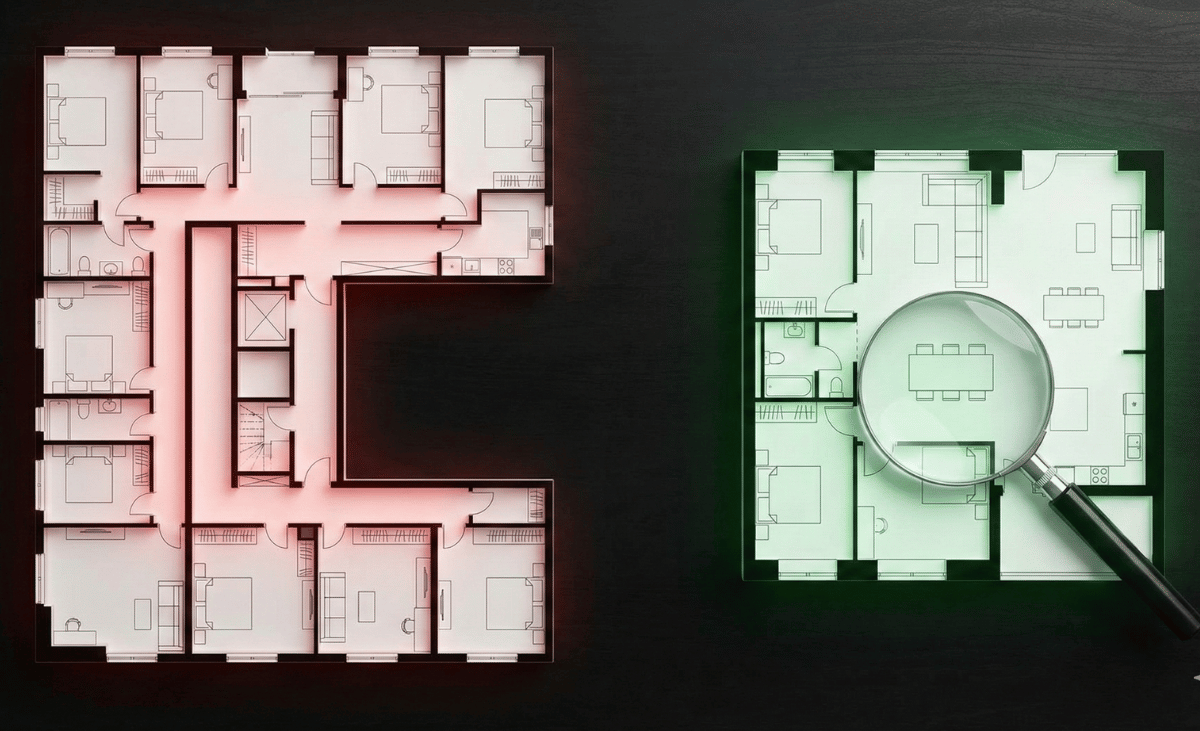

A common myth is that a “maturing” market means fewer opportunities for profit. The reality is the opposite—the opportunities just look different. In an advanced market like the one Dubai is entering, value is driven by strategic positioning, careful asset selection, and precise timing.

What This Means For You

Investors who enter during this current transition phase benefit from wider choice and pricing flexibility. Those who wait for the “perfect stability” of late 2026 will likely face higher entry costs and stiffer competition.

3. The 2026 Pivot: From Future Promises to Tangible Reality

The period leading up to 2026 is a pivotal window. We are about to see a significant volume of off-plan stock transition into completed, liveable assets. This shift changes the supply balance from “future developments” to “available properties.”

As this happens, pricing mechanisms become more efficient, and growth opportunities move from “expectation” to “tangible reality.” Early entry allows you to align with this progress rather than merely reacting to it later.

4. Expert Insight: The “First Mover” Advantage

According to market insights shared by real estate expert Tariq Al Shehhi, founder of TREstate Real Estate, the fundamentals of early movement remain unchanged.

In short: Discipline beats speculation. Thoughtful positioning now, in the early stages of this new cycle, is the key to securing capital appreciation, stable rental income, and flexible exit strategies over the medium to long term.

Don’t Wait for the Finish Line

As Dubai moves closer to 2026, the market is advancing on strong foundations. The “Wild West” days may be over, but they have been replaced by something better: sustained, predictable growth.

Stable returns are achieved by those who recognize the path early, not those who wait for the road to be paved.