The Investor’s Dilemma: Capital Appreciation vs. Rental Yield

Most novice investors confuse price growth with rental yield. They want a “unicorn” property that doubles in value overnight and pays 10% annual rent. In reality, these are two different engines driving your portfolio, and they rarely run at max speed simultaneously. Understanding the mechanics of each is the first step to building real wealth.

The Fundamental Difference

Defining the Two Engines

1. Price Growth (The “Wealth Multiplier”):

This is the increase in the market value of your asset over time. It is driven by scarcity, location prestige, and infrastructure development.

Example: A luxury apartment on Palm Jumeirah bought for AED 5M might be worth AED 8M in five years. You don’t see this money daily, but your net worth grows significantly.

2. Rental Yield (The “Cash Flow”):

This is the annual income you pocket relative to the property price. It is driven by affordability and tenant demand.

Example: A studio in International City bought for AED 400k might rent for AED 36k, giving you a 9% gross yield. It pays the bills today, but the property value might only rise to AED 450k in the same five-year period.

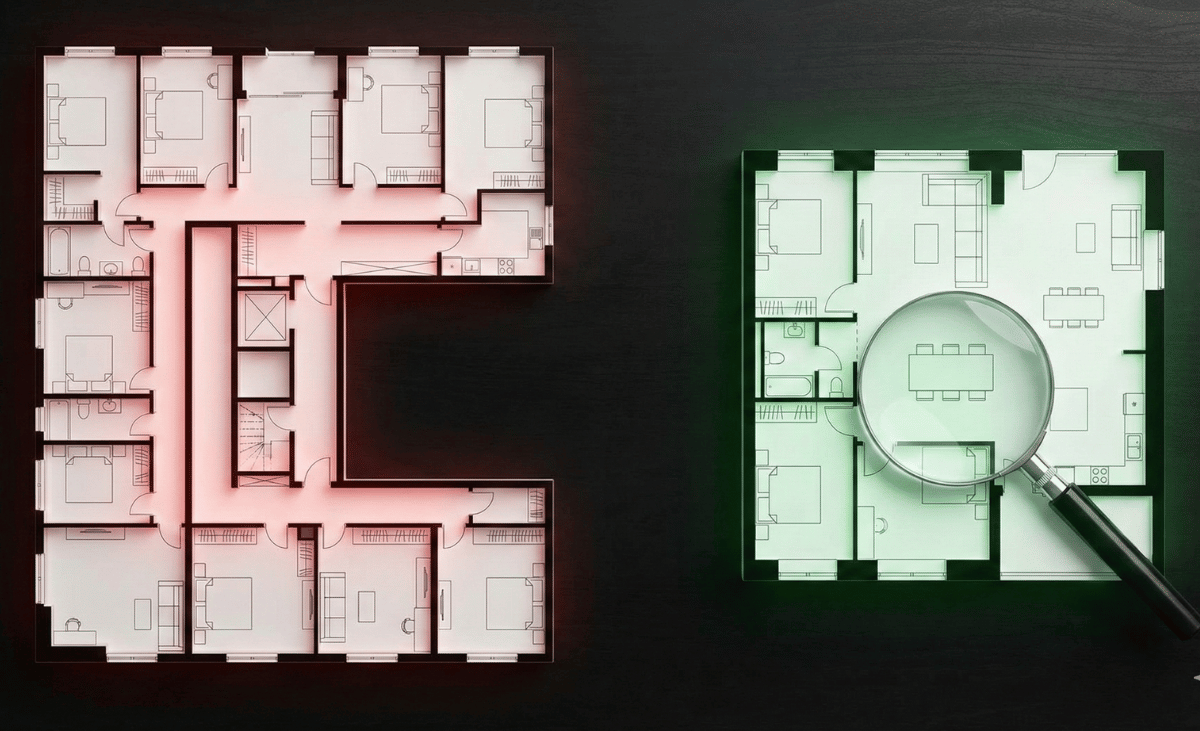

The “Hidden” Factor: Service Charges

When calculating yield, many investors forget to factor in service charges, which can drastically eat into your “Cash Flow” strategy.

Luxury towers in Downtown or Marina often have high service charges (AED 20-30 per sq. ft.), which reduces your net yield. Conversely, villa communities or mid-market areas often have lower fees, allowing you to keep more of the rental income. Always calculate Net Yield, not Gross Yield, before making a decision.

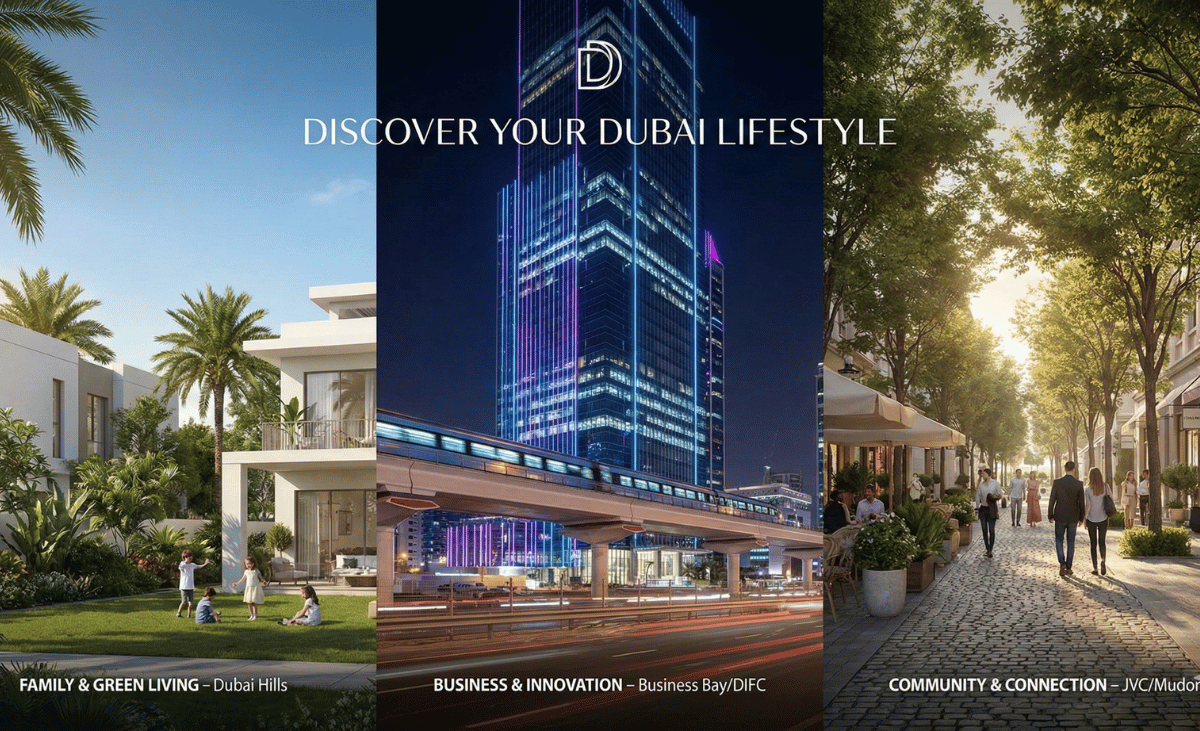

Which Strategy Fits You?

The “Legacy Builder” (Focus: Appreciation)

If you are buying to build a nest egg for retirement or to sell in 10 years for a massive profit, focus on Capital Appreciation. You want “Blue Chip” locations (Downtown, Palm Jumeirah, Dubai Hills) where land is limited. You are less concerned with monthly checks and more concerned with the exit value in 2030.

The “Salary Supplementer” (Focus: Yield)

If you are using real estate to replace your salary, pay for your children’s education, or cover a mortgage, you need high Cash Flow now. You might sacrifice some future capital growth for steady 8-9% returns today. Look at high-density areas like JVC, Discovery Gardens, or Dubai South.

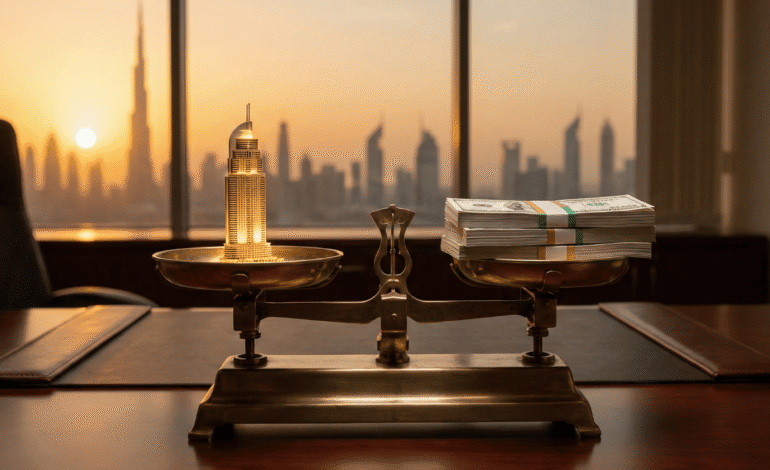

Smart Buying: The Portfolio Balance

Smart buying is not about choosing one blindly. It’s about balancing both based on your lifecycle.

Many successful investors use a “Barbell Strategy”: they own one high-yielding property to generate cash that covers expenses, and one high-appreciation property that builds long-term equity.