Don’t Buy Until You Know How to Sell: Why Exit Strategy Matters

It is easy to buy property in Dubai. You sign a form, pay a deposit, and you are an owner. But realizing your profit? That happens when you sell. The biggest mistake novice investors make is worrying about the “Entry” (price, location) without thinking about the “Exit.” Every smart buyer should know exactly how they will exit before they even sign the contract.

The Three Main Exits

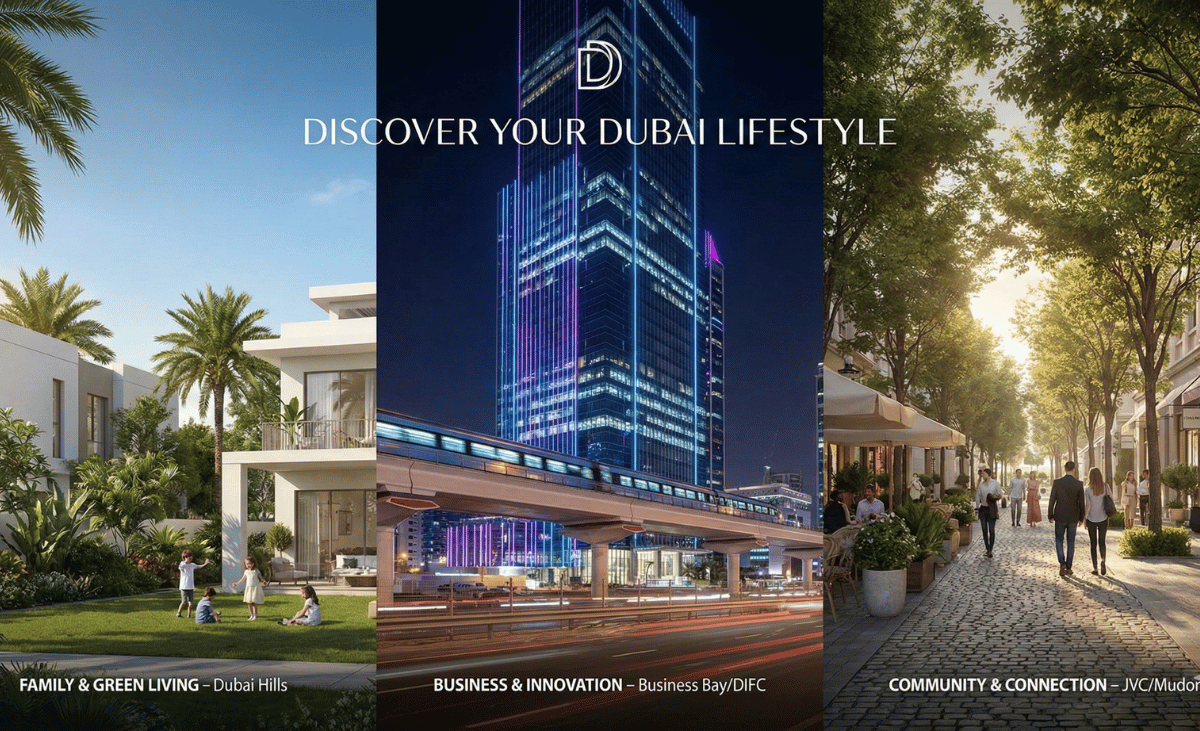

Different exits require completely different buying criteria. If you don’t know which game you are playing, you will lose.

- The Strategy: Buy early off-plan at the lowest price, and sell just before handover when the building is visible and hype is high.

- What to Buy: High-demand, iconic projects with a unique selling point (e.g., waterfront). You need a project that will have a waiting list of buyers later.

- Risk: High. If the market slows down, you might be stuck with a property you can’t complete.

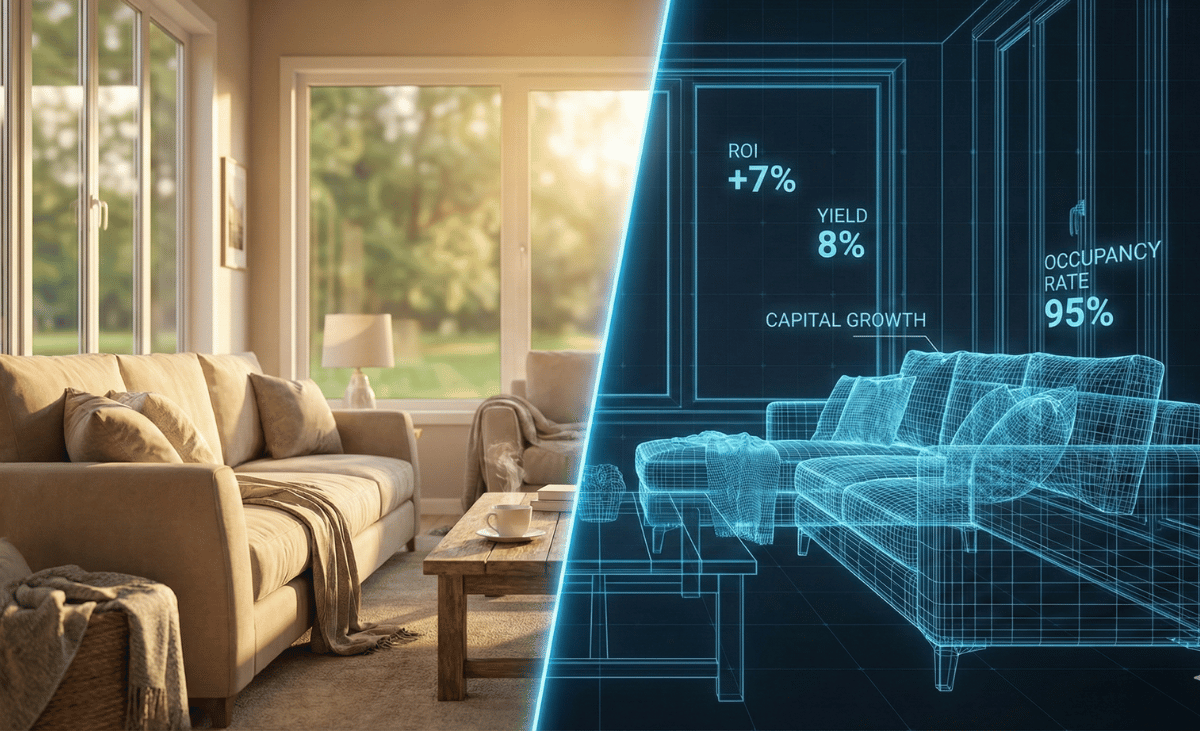

- The Strategy: Buy to rent out for 5-10 years. You are looking for passive income to replace a salary.

- What to Buy: Durable units in high-occupancy areas (JVC, Business Bay, Dubai South). Focus on low service charges to maximize net income.

- Risk: Low. Even if property prices dip, rent usually keeps coming.

- The Strategy: Buy a trophy asset, live in it or keep it vacant, and sell in 10+ years for massive equity growth.

- What to Buy: Prime, scarce locations (Palm Jumeirah, Downtown). Land that cannot be replicated.

- Risk: Medium. Requires patience and holding power.

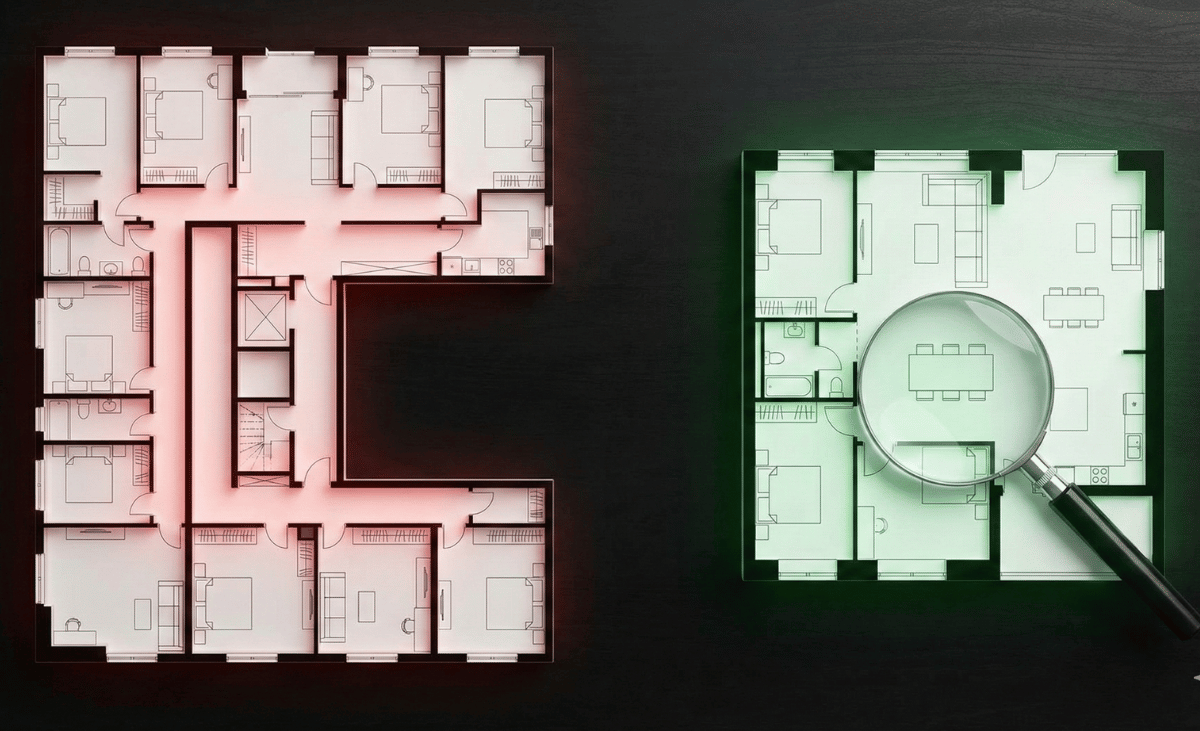

The Liquidity Trap

Another critical factor is Liquidity. How fast can you sell if you need cash?

If you buy a super-luxury niche penthouse for AED 50 Million, your buyer pool is tiny (maybe 50 people in the world). Selling might take 12-18 months.

If you buy a standard 1-bedroom in Dubai Marina, your buyer pool is massive (thousands of investors). You can likely sell it in 2 weeks at the market price. Know your liquidity needs before you lock up your cash.