Commercial vs Residential Property in Dubai

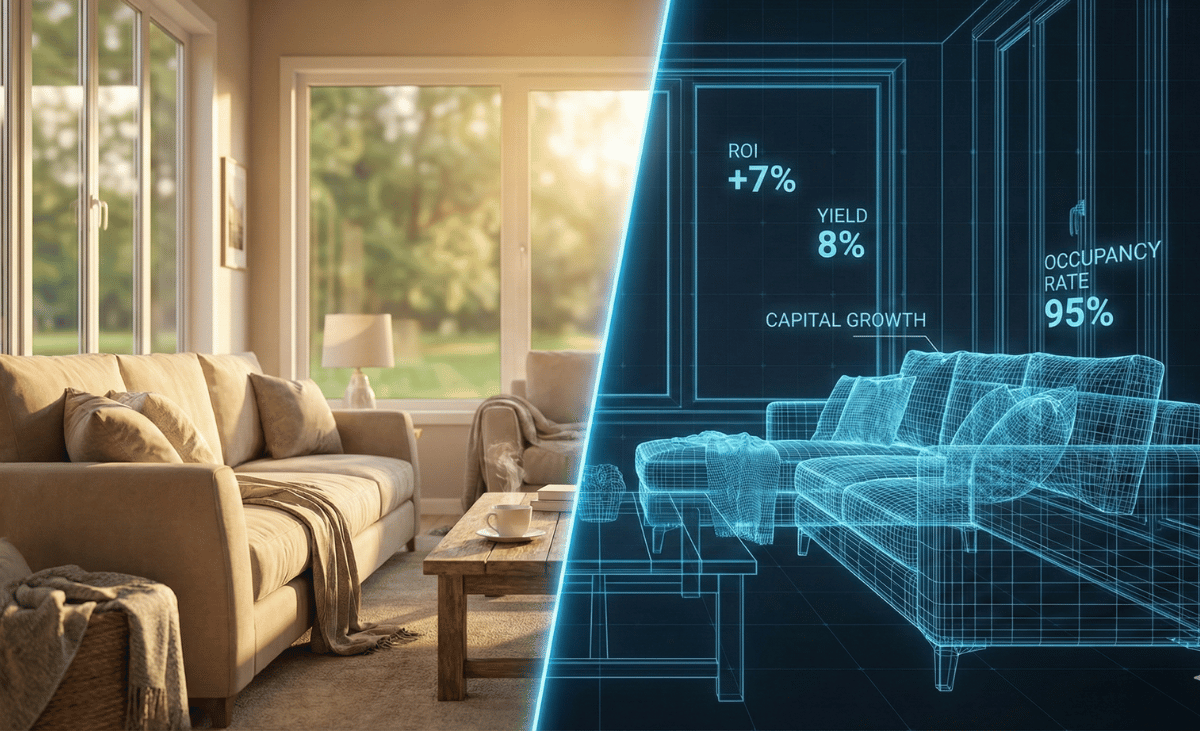

While 95% of Dubai’s real estate transactions focus on residential properties, savvy investors are discovering exceptional opportunities in the commercial sector—where prime locations, superior ROI, and long-term stability create a compelling case for portfolio diversification.

The Market Reality: A Hidden Opportunity

Dubai’s property market reached AED 430 billion in transactions during H1 2025, with the vast majority concentrated in residential developments. However, this creates a unique opportunity: commercial properties, representing only 5% of investor portfolios, are delivering 8-10% average ROI compared to residential’s 6-8%—and the gap is widening.

2025 Market Performance

Why Commercial Properties Outperform

Commercial Advantages

Higher Returns: Average yields of 8-10% in prime locations like Business Bay and DIFC

Longer Leases: 3-5 year contracts provide predictable income with less turnover

Corporate Tenants: Multinational companies offer stability and creditworthiness

Tenant Pays More: Businesses typically cover maintenance, fit-outs, and utilities

Residential Characteristics

Moderate Returns: 6-8% yields in most communities

Shorter Leases: 1-2 year contracts with frequent tenant changes

Higher Turnover: More vacancies between tenants

Easier Entry: Lower capital requirements and faster resale potential

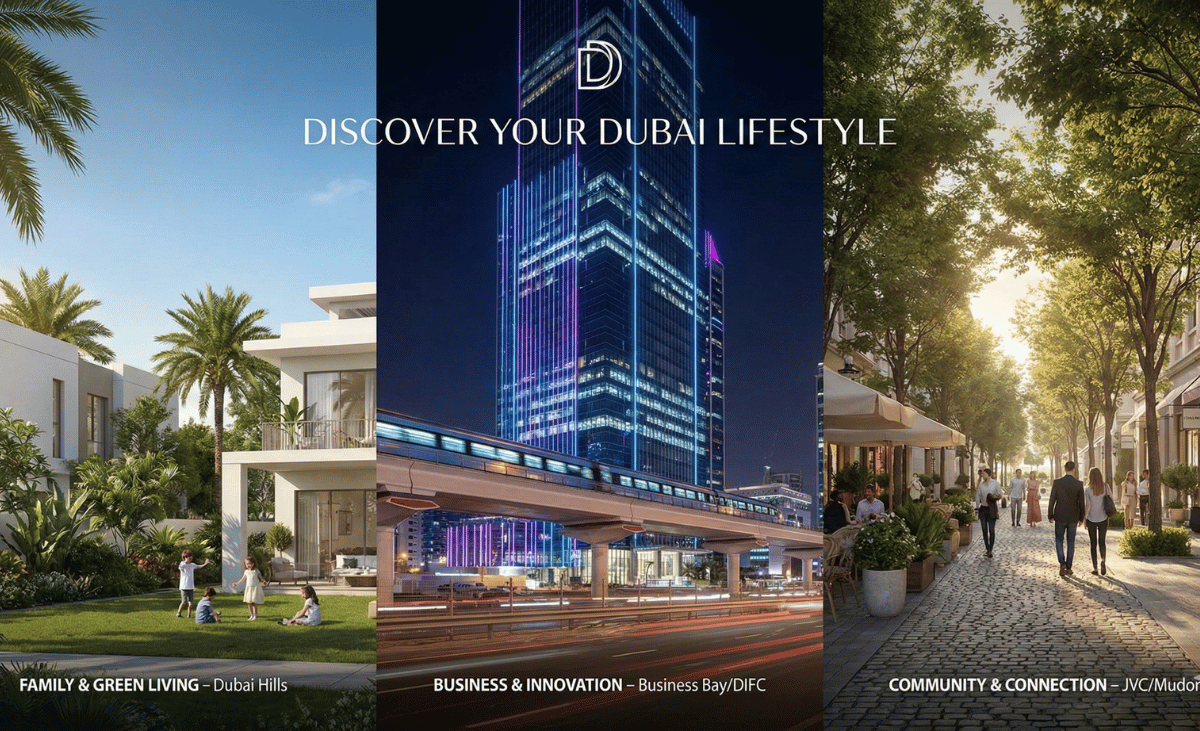

The Prime Location Factor

Location drives commercial success more than any other factor. Prime areas where professionals seek both offices and residences nearby command premium rents and maintain high occupancy rates. These locations benefit from:

What Makes a Commercial Location Prime?

- Proximity to business districts and financial centers

- Excellent connectivity via Metro and major highways

- Surrounding residential communities providing workforce

- Established infrastructure and amenities

- Growing corporate presence and business ecosystem

- Limited supply of Grade-A commercial space

Top Commercial Hubs in Dubai

Several areas have emerged as premier destinations for commercial investment, each offering unique advantages:

Business Bay: Led Q3 2025 with 937 commercial transactions and office sales of AED 3.1 billion—a 93% annual growth. Its central location and proximity to Downtown Dubai make it the most sought-after commercial address.

DIFC (Dubai International Financial Centre): The financial heart of the UAE, offering Grade-A offices with ROI averaging 8-9%. Tax-free advantages and Michelin-rated dining attract global corporations and family offices.

Sheikh Zayed Road: The iconic corridor remains a top choice for global companies, with unmatched prestige, world-class connectivity, and skyline views. Average commercial yields reach 8-9%.

Dubai South: An emerging hub with over 680,000 square meters of new office space expected by 2027, offering early-entry opportunities at competitive prices.

Leading Commercial Developers in Dubai

While numerous developers focus on residential towers, only a select few are creating truly exceptional commercial properties in prime locations. Several prominent names dominate the premium commercial landscape:

Premier Commercial Developers

DAMAC PROPERTIES

Specialty: Luxury mixed-use developments

Notable Projects: DAMAC Hills, Business Bay towers, DAMAC Towers by Paramount

Edge: Branded collaborations, premium amenities, strategic locations

SOBHA REALTY

Specialty: High-end commercial spaces

Notable Areas: Sobha Hartland, Business Bay, MBR City

Edge: Quality craftsmanship, timely delivery, premium finishes

NAKHEEL

Specialty: Mega-project commercial hubs

Notable Projects: Palm Jumeirah retail, Deira Islands, Dragon City

Edge: Iconic locations, massive scale, government backing

MERAAS

Specialty: Lifestyle-integrated commercial

Notable Projects: City Walk, Bluewaters Island, La Mer

Edge: Tourism integration, retail excellence, waterfront locations

SELECT GROUP

Specialty: Modern commercial complexes

Notable Areas: JVC, JLT, Business Bay

Edge: Innovative designs, smart technology, competitive pricing

WASL PROPERTIES

Specialty: Government-backed developments

Notable Projects: Wasl Hub, various Business Bay assets

Edge: Prime land bank, long-term stability, institutional quality

The Investment Case: Why Choose Commercial?

1. Superior Long-Term Returns

Commercial properties consistently outperform residential in total returns. While residential offers 6-8% yields, prime commercial spaces in Business Bay, DIFC, and Sheikh Zayed Road deliver 8-10%—and in some ultra-luxury cases, exceed 11%. This 2-3% difference compounds significantly over time.

2. Recession-Resistant Tenants

Established corporations on multi-year leases provide stability even during economic fluctuations. Unlike residential tenants who may break leases, businesses have reputational and operational reasons to honor long-term commitments.

3. Lower Maintenance Hassle

Commercial leases typically require tenants to handle fit-outs, maintenance, and utility costs. This “triple net” structure means investors receive cleaner, more predictable income with minimal management burden.

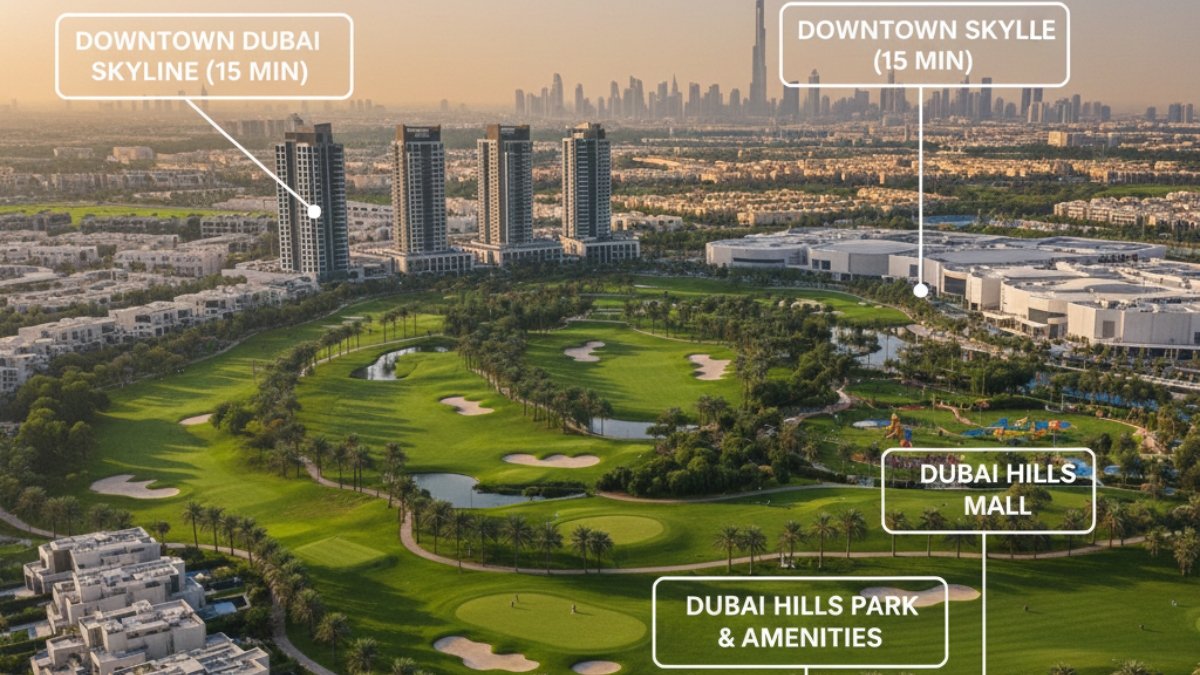

4. Capital Appreciation in Prime Zones

With limited land and strict planning in areas like Business Bay and DIFC, commercial properties in these locations benefit from scarcity value. Secondary market office prices reached AED 1,685 per square foot in Q3 2025—the highest in a decade.

5. Portfolio Diversification

When 95% of investors focus on residential, commercial properties offer true diversification. Different market cycles, tenant profiles, and income structures create a balanced portfolio less vulnerable to sector-specific downturns.

Smart Investment Strategies

For First-Time Commercial Investors

Start with smaller office units in established mixed-use communities like Business Bay or JLT. These typically require AED 1.5-3 million investment, offer good liquidity, and attract diverse tenant profiles from startups to regional offices of international firms.

For Seasoned Investors

Consider full floors or multiple units in Grade-A towers developed by OMNIYAT or Emaar in DIFC or Sheikh Zayed Road. These command premium rents, attract multinational corporations, and deliver both strong yields and capital appreciation.

For Portfolio Builders

Balance 60-70% commercial with 30-40% residential. This strategy captures commercial’s higher yields while maintaining residential’s liquidity. Focus commercial holdings in Business Bay, DIFC, and emerging hubs like Dubai South for growth potential.

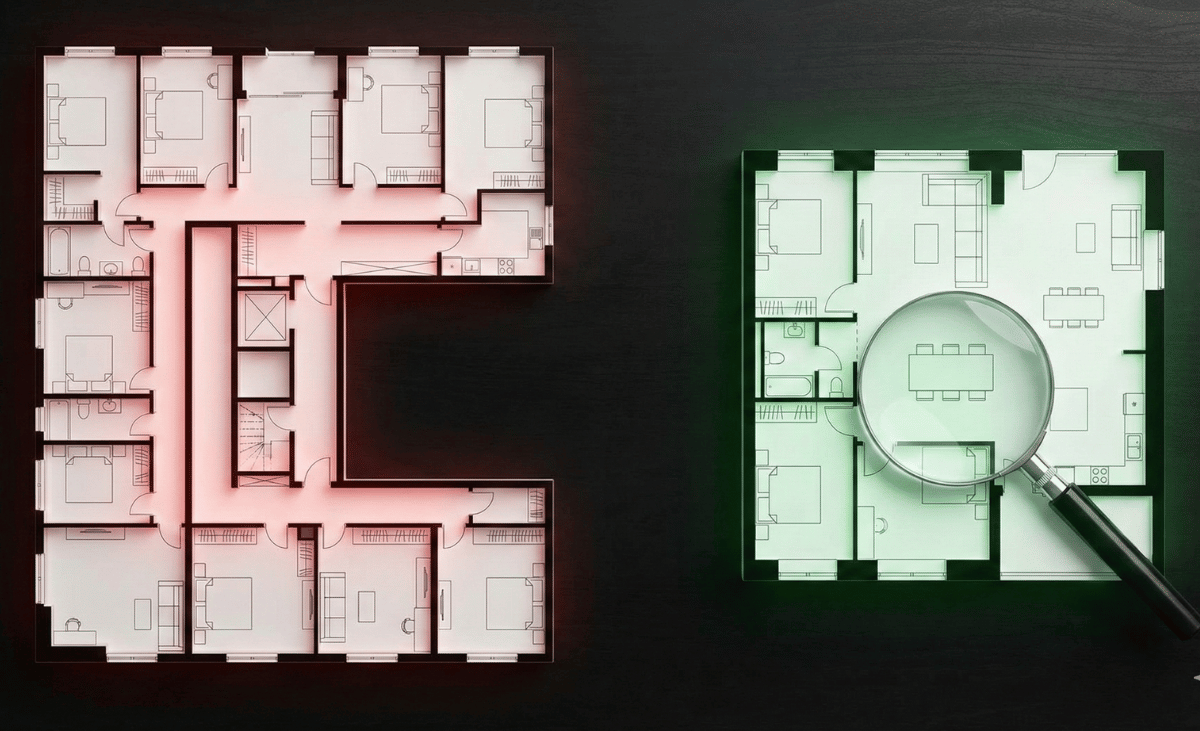

Critical Considerations

Higher Entry Cost: Commercial properties typically require 20-30% down payments versus 15-20% for residential. Budget AED 2-5 million minimum for quality commercial units in prime locations.

VAT Implications: Commercial properties are subject to 5% VAT on both sale and rental, unlike residential. Factor this into ROI calculations.

Longer Sale Cycles: Commercial properties take longer to sell than residential. Plan for 3-5 year holding periods minimum to maximize returns.

Due Diligence: Research tenant mix, building management quality, and area development plans. A well-managed building in a growing district significantly outperforms average properties.

The Future Outlook

Dubai’s commercial sector is poised for continued growth through 2026 and beyond. Several factors support this bullish outlook:

Corporate Expansion: Over 12.4 million visitors in the first nine months of 2025, coupled with Dubai’s status as a global business hub, drives sustained demand for office space. Technology, financial services, and tourism sectors continue expanding operations in the emirate.

Limited Supply: Prime office vacancy rates of just 8.6% in Dubai and 2.3% in Abu Dhabi create upward pressure on rents. While 680,000+ square meters of new space is planned by 2027, much of this targets emerging areas rather than established prime districts where major developers like DAMAC, Sobha, Meraas, and Nakheel continue to dominate.

Economic Growth: Dubai’s GDP grew 3.2% in 2024, reaching AED 231 billion, with the transport and storage sector expanding 13.6%. This economic momentum translates directly into commercial real estate demand.

Commercial Market Forecast

Making the Smart Choice

The decision between commercial and residential investment isn’t binary—it’s strategic. While residential offers accessibility and liquidity, commercial properties in prime locations deliver superior ROI, stable long-term income, and genuine portfolio diversification.

For investors serious about maximizing returns, the math is compelling: commercial properties in Business Bay, DIFC, and Sheikh Zayed Road consistently outperform residential by 2-3% annually. Over a decade, this difference can mean hundreds of thousands of dirhams in additional returns.

Moreover, with only 5% of investors currently focused on commercial real estate, you’re positioning ahead of the curve. As more investors recognize these advantages, competition for prime commercial assets will intensify—making early entry crucial.

Final Investment Checklist

- Prioritize prime locations: Business Bay, DIFC, Sheikh Zayed Road

- Focus on Grade-A buildings by reputable developers with proven track records

- Target corporate tenants on multi-year leases

- Verify building management quality and occupancy rates

- Plan for 3-5 year minimum holding period

- Budget for 20-30% down payment plus transaction costs

- Consider professional property management services

- Review all lease terms and tenant responsibilities